Yesterday (Thursday 26 March 2020), global equity markets shrugged off the poor US jobless claims data and instead focused on benefits of the US economic stimulus package. On Wall Street, the Dow Jones closed up 6.38% and the S&P 500 ended the day up 6.24%. In the UK, the FTSE-100 ended yesterday up 2.24% – although it is, as we write, down 4.5% or 262 points.

US new jobless claims skyrocketed to 3.28m people for the week ending 21 March 2020 as businesses shutdown and laid off workers to slow the spread of the coronavirus – just two weeks ago the number stood at just 211,000!

This clearly highlights the speed and magnitude of the economic damage from the coronavirus outbreak and confirms to us that we are currently in a global recession – so these very high numbers are likely to continue for the next few weeks or months.

In the UK, yesterday’s BoE monetary policy announcement was fairly bland and it was Rishi Sunak’s (the Chancellor of the Exchequer) fiscal announcement regarding help for the self-employed which was far more important. BoE policymakers voted unanimously to keep interest rates on hold at 0.1% and said they were ready to expand QE if needed – the BoE has been very aggressive this month in cutting interest rates and expanding QE to limit the coronavirus damage to the UK economy.

With the majority of the global economy now in some form of lockdown restriction, it means the global economy has effectively suddenly stopped and as such the economic shock will be abrupt and deep. However, we believe the announced economic stimulus packages should mitigate widespread long-term unemployment and insolvencies, and as such the economic contraction should be short. Consequently, we expect the global economy will start to recover towards the end of the year.

Although the Dow Jones is now just over 20% above its 23 March 2020 low and the FTSE-100 is currently just over 10% above its low, unfortunately, we would caution that it is too early to believe the worst is over as it has become apparent that while economic data will make great news headlines, it is likely to be of limited value until the spread of the coronavirus is under control and the lockdowns have been lifted.

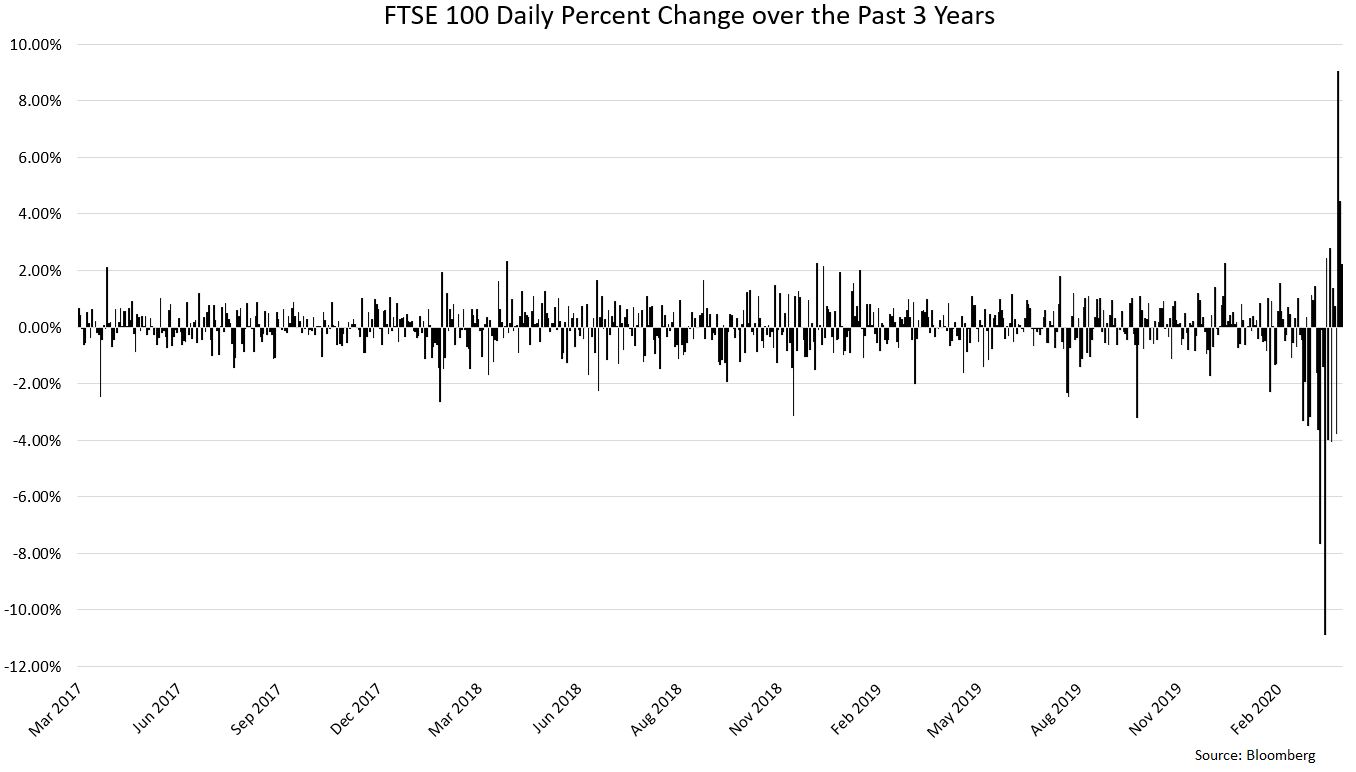

As such, we expect the current elevated market volatility will continue. While we appreciate that this is unnerving, as you can see from this chart, the current volatility is unprecedented – over the past month we have regularly seen daily moves of 4 or 5% and a couple of days where the moves have been as much as plus or minus 10%!

Equity markets hate uncertainty – and the coronavirus outbreak is a big uncertainty – and when this uncertainty is removed markets will undoubtedly steady and return to more normal moves of 1 or 2% per day – which you can see has been the norm in the past 3 years. As such it is very important to maintain a long-term perspective and resist the urge for any knee-jerk reactions. In the meantime, we want you to know that we are doing everything we can to ensure you are kept fully up to date.

Although the majority of economic data releases will be of limited value as they pre-date much of the coronavirus slowdown, such as this coming Tuesday’s (31 March 2020) Q4 UK GDP data, we are keenly awaiting and watching next Friday’s (3 April 2020) UK PMI data (that is Purchasing Managers Index) for an indication of the negative impact the coronavirus outbreak has had on the UK’s manufacturing and services sectors.

Additionally, from the US we will have the weekly jobless claims, along with US non-farm payroll data; unemployment rate; participation rate; and average earnings. While from the Eurozone, we have industrial confidence and PMI data.