Market Update – Coronation Special

4th May 2023

King Charles III’s coronation will take place on Saturday 6 May 2023 at Westminster Abbey in London. Looking back to 1952 when Queen Elizabeth ascended to the throne, today’s economic environment isn’t too dissimilar. Whilst interest rates were low at around 2%, (although the make-up of inflation was very different back then) inflation had climbed to just over 9%, resulting in a cost-of-living crisis.

Since 1952 the UK economy has had eight recessions and had to weather numerous crises. The 1956 Suez Canal Crisis highlighted the UK’s loss of world power and following the relative economic calm of the 1960s, we had the oil shock of the 1970s and an IMF bailout; the 1980s deregulated and the 1987 stock market crash; the 1990s dot-com bubble; the 2001 US terrorist attacks; the 2008/9 global financial crisis; Brexit; and most recently, Coronavirus.

Despite this the UK economy has prospered and is today far bigger than it was back in 1952. Interestingly, over the years, despite all the uncertainty and volatility caused by the issues listed above, UK equity market returns have been impressive. According to data from the annual Equity Gilt Study produced by Barclays, over the last 70 years, the average annual return on UK equities has been roughly 12% (being 6.4% in real terms plus the negative effects of inflation, which averaged just over 5% per annum over the period).

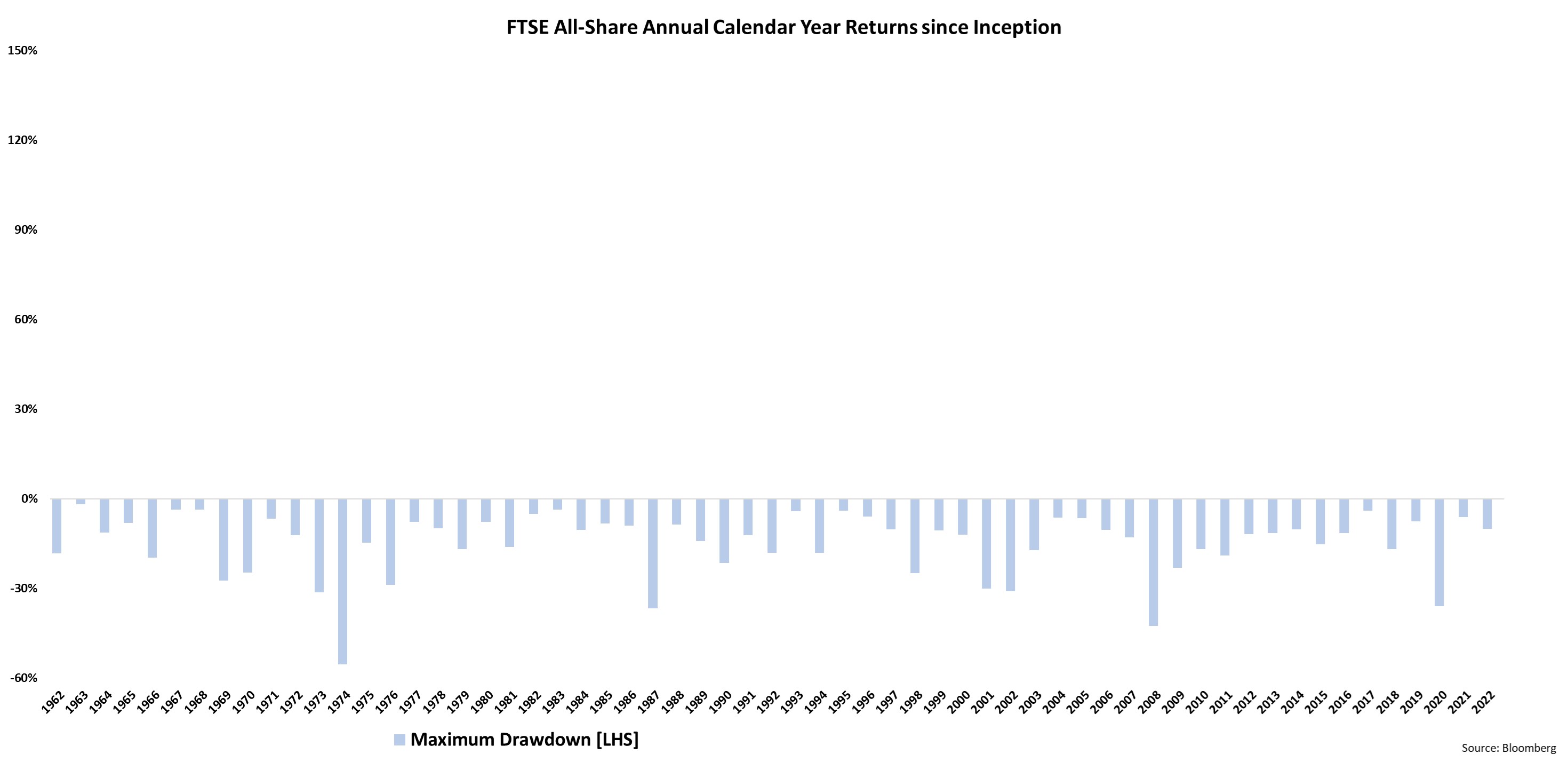

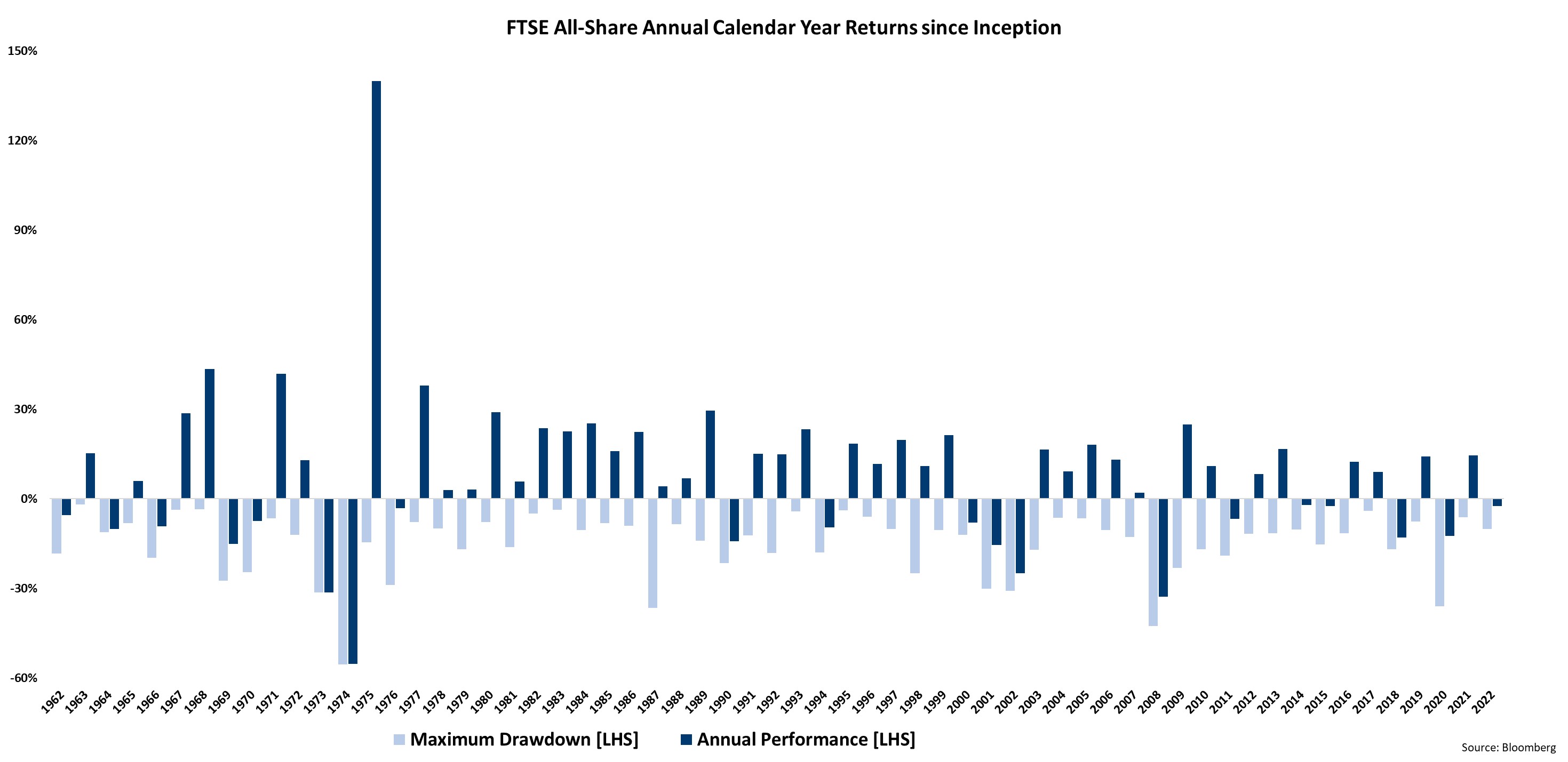

We obviously understand that no-one has a 70-year investing horizon – we believe that a 15+ year investment time horizon is more appropriate, especially given today’s retirement and life expectancy. We can go back to April 1962 using the FTSE All Share Index and look how markets have performed over time.

The light blue bars in the below chart shows that despite impressive long-term returns, equity markets will, at some point in a calendar year, see negative returns – often of 5% or 10%.

Despite these regular sell-offs, however uncomfortable they may be, as one can see, when we overlay the chart with the annual equity markets returns (in dark blue), these intra-year sell-offs are quickly reversed allowing long-term investors to come out on top.

We believe that this illustrates an important, and timeless, lesson that one should never forget: while investing in equity markets is risky, it is obviously more so if one has only a short-term time horizon. The longer one is prepared to invest, the less risky it will likely become and therefore the greater one’s actual and real returns will become, as equities have historically weathered crashes, recessions and inflation.

For example, when the FTSE-100 had its biggest ever one day fall on 19 October 1987, not only did the FTSE-100 still end 1987 higher than it started, the losses were completely reversed by July 1989 and today, the crash is hardly noticeable on a long-term chart.

Looking ahead to what we can anticipate under King Charles III’s rule, as ever there is no shortage of risks that we could list; the most obvious are inflation, hawkish central banks, the cost-of-living crisis, as well as the ongoing war in Ukraine, the UK’s trading relationship with the EU, and supply chain disruptions.

Whilst we fully appreciate that the path for equity markets is never smooth or easy, and as such, it is easier said than done, the best way to maximise returns isn’t by trying to time the market; it is to maximise time in the market. Whilst one may consider cash to be a safe investment, in the current economic climate there is a far greater chance of its value being eroded by inflation (which averaged at just over 5% during the Queen’s reign) and we don’t believe this is likely to change.

However, history has shown us that global equity markets can deal with any eventuality, they simply hate periods of uncertainty – and what is happening today is far from extraordinary. Unfortunately, that uncertainty is not helped by the fact that today we all know what is happening in real time, given the number of 24-hour news stations and social media networks that weren’t around in 1952.

We take an active, discretionary approach to managing client portfolios, which adds significantly more value than passive management. Our team of qualified Investment Managers can respond and adapt a client’s portfolio to changing market conditions by making immediate portfolio changes.

The Investment Management Team isn’t granted complete freedom though, because managing clients’ investments is a serious obligation that calls for restraint and strict risk management. Since we think that risk management is equally as significant as investment performance and returns, risk management is actually a key component of how we create and monitor our portfolios.

As a result, we will never shoot the lights out with our investment performance. Instead, we strive to offer consistency: a modest but dependable outperformance will result in improved loongterm outperformance, as even a slight increase in annualised returned can result in a large shift in a portfolio’s value over time.

Although there is no way to prevent all investment losses in the short or long term, our goal is to ensure clients have the information they need to understand the risks involved and make informed decisions. As for what we are doing with our client portfolios given today’s uncertainties, we are going to follow the advice that the late Queen no doubt gave King Charles before her passing: discipline, patience, consistency and a preparedness to change, all of which make up the cornerstone of our investment philosophy.

God save the King.

Investment Management Team