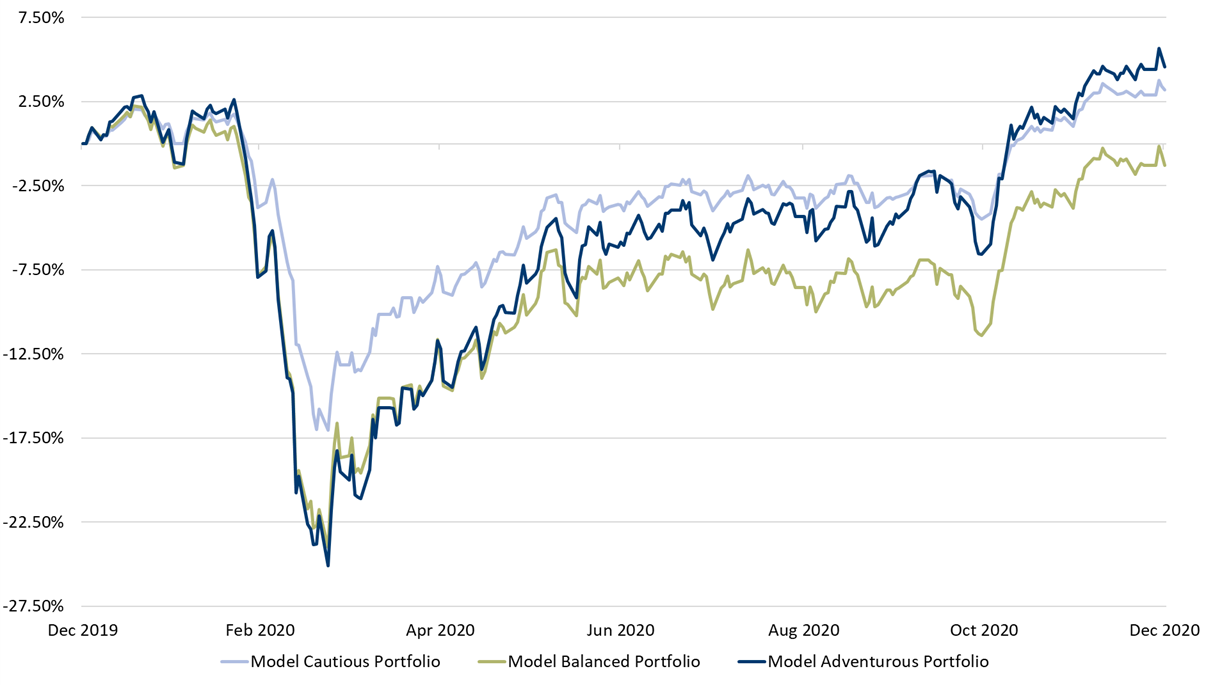

Some of our portfolio changes at the start of the coronavirus outbreak included the reduction or the complete sale of holdings in those companies which we believed would see long-term damage, such as Carnival Cruises, Compass, Informa and Melrose Industries. Due to the heightened level of market uncertainty, these sales predominately increased portfolio cash balances, thus reducing client’s market exposure and risk – as we view our clients’ investments too important to risk if we were to get it wrong (at my wealth, our core philosophy is that if we wouldn’t do it for our mum and dad, then we don’t do it for our clients).

Obviously, with the benefit of 2020 hindsight, we perhaps should have been more aggressive and invested in companies that could potentially benefit from the coronavirus disruption, such as the online food retailer, Ocado. Despite having plenty of negative social media comments due to capacity constraints which restricted the number of deliveries Ocado could make, coupled with the fact it had to limit sale of certain items such as toilet paper and pasta, the company’s share price rose strongly during 2020, thanks to the significant and permanent shift to online food shopping, with Tim Steiner, the Chief Executive, stating that the UK market has doubled since the coronavirus outbreak!

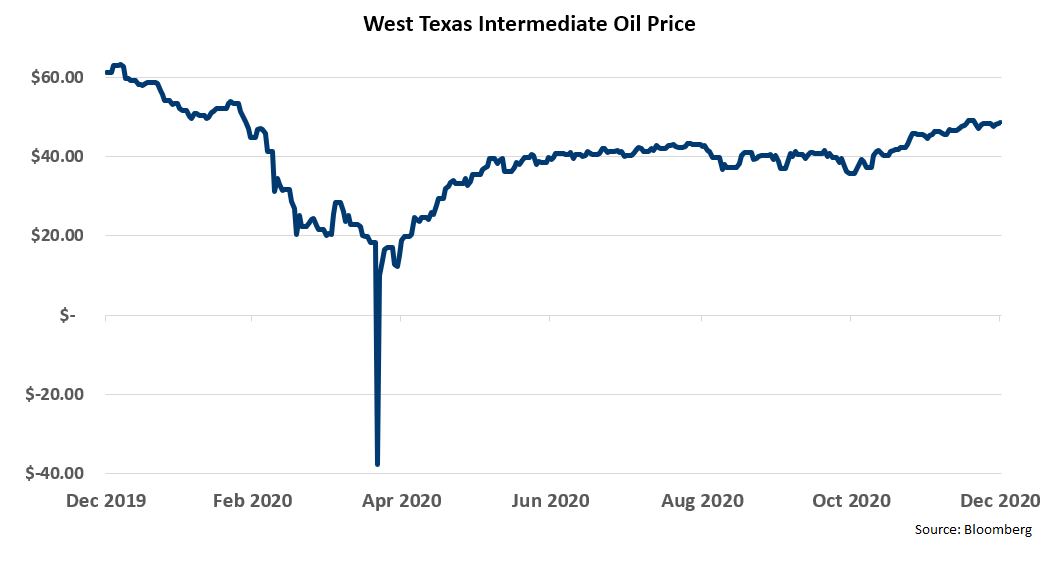

However, more recently we have started to reduce cash levels held in client portfolios by predominately increasing clients’ exposure to UK equities in order to reduce some of our underweight position in this geographic region. This has predominately been via the commodity and oil companies (such as BHP, BP, Glencore and Royal Dutch Shell) as we expect the price of oil and metals to move higher in 2021 given China’s appetite for commodities, coupled with a weaker US dollar and a continuation of the economic recovery we have seen since the summer; as the roll-out of the coronavirus vaccines will allow the global economy to fully reopen in 2021 and more importantly, stay open.

We have also increased exposure to sectors such as financials which should not only get a boost from the economic recovery, but also the expected restoration of dividends.

We have also reorganised our US and European holdings. In the US, this involved reducing exposure to US equity income funds (i.e. those funds that focus on investing in US companies that pay dividends), as these funds are all now starting to chase the same dividend-paying companies, which meant that these funds started to become similarly positioned (which obviously reduces the underlying diversification of our Cautious, Balanced and Adventurous portfolios).

In Europe, the reorganisation skewed the underlying holdings more towards domestically focused companies, which should benefit from the European Central Bank’s (ECB) accommodative monetary policy, as we believe that it is when, not if, the ECB provides additional monetary stimulus.

We continue to favour Asian and Emerging Markets, especially as trade tensions are likely to ease under a Joe Biden US Presidency. However as not all Emerging Markets are similar (for example, while both China and Greece are officially classified as Emerging Markets, they have very little in common), we have blended our Asian and Emerging Markets funds so that their underlying holdings are more exposed to those countries which responded and contained the coronavirus quickly and those companies that should benefit the most to global economic growth. Additionally, despite all the coronavirus disruption during 2020, the long-term drivers underpinning many of the Asian and the Emerging Market countries are still intact, for example, the demographic trend with the population of working age people is still growing – and that is important as this supports domestic demand growth and as incomes rise, so does discretionary consumption.

Furthermore, additional stimulus from the major government and central banks can’t be ruled out – and a non-inflationary moderate growth environment with supportive fiscal and monetary policies should be very positive for global equity markets as a whole in 2021.

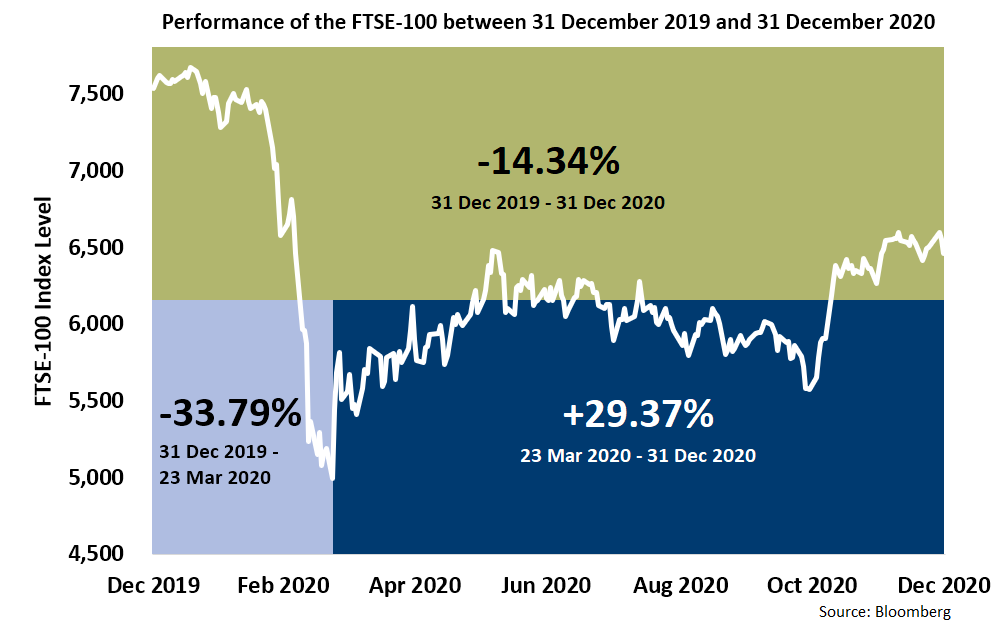

However, the path for equity markets is never smooth or easy as there will always be periods of market uncertainty and volatility – as Mark Twain said, “history doesn’t repeat itself, but it often rhymes”.

As such, we fully expect the tug of war between the short-term coronavirus impact and the speed of the vaccine roll-out will keep equity market volatility elevated (although hopefully not at the extreme levels we experienced in March and April 2020), with large up-and-down price movements, for the foreseeable future.

However, it is important not to underestimate the potential size and speed of the economic recovery that we will see during 2021/2022 as the roll-out of the coronavirus vaccines will improve consumer confidence thanks to pent up demand, fiscal stimulus and low interest rates – which is all very positive and should not only mean the consumption of toilet paper will be out and demand for traveling and eating out will be back in, but more importantly, drive global equity markets higher during the year.

Consequently, whilst we accept that it is easier said than done amidst the current uncertainties, it is very important to filter out the cacophony of unhelpful market noise and resist the urge for any knee-jerk reactions by maintaining a long-term perspective as the coronavirus outbreak will soon be in the rear-view mirror and will be seen as an economic hiccup; albeit a sharp, deep and painful one.

In the words of the poet Alfred Lord Tennyson, “hope smiles from the threshold of the year to come, whispering, ‘it will be happier.’”

Good riddance 2020, bring on 2021!

Investment Management Team