Market Update – 14th September 2022.

15th September 2022

Her Majesty, Queen Elizabeth II was not only the one reigning monarch we have known, but she was a much needed and very reassuring constant and inspiration to us given the huge economic changes over the last 70 years. Her reign spanned the UK’s journey from Empire to the EU and then Brexit; and from the radio to the smartphone.

When Queen Elizabeth ascended to the throne in 1952, the UK was a very different place. We were effectively struggling to shake-off the war years: sugar, butter, cheese, meat and tea were all still rationed; and Winston Churchill had just returned to office for his second stint as Prime Minister. Newcastle United were about to beat Arsenal to win the FA Cup for a then-record fifth time; and sadly, towards the end of the year London was covered in smog for 5 days, resulting in thousands of deaths.

However, 1952 had one very big similarity with today: in 1952 interest rates were low at around 2%, while inflation had climbed to just over 9%, resulting in a cost-of-living crisis (although back then the make-up of inflation was very different as it included radios, mutton, wild rabbit, sardines, custard powder, canned plums, corsets and a shampoo & set; whereas today it includes items such as mobile phones, music streaming subscriptions, sweet potatoes, avocados, dishwasher tablets, replica football shirts, leg waxing and slimming club fees).

In the intervening 70 years, whilst the Queen remained an enduring figure of resilience, the UK economy had eight recessions and had to weather a number of major crises. The 1956 Suez Canal Crisis highlighted the UK’s loss of world power and then following the relative economic calm of the 1960s, we had the oil shock of the 1970s and an IMF bailout; the 1980s deregulated and the 1987 stock market crash; the 1990s dot-com bubble; the 2001 US terrorist attacks; the 2008/9 global financial crisis; Brexit; and most recently, coronavirus.

Despite this the UK economy has prospered, and is today far bigger than it was back in 1952. Additionally, it has moved from being roughly evenly split between services and manufacturing, to a predominately serviced based economy as a result of automation and the rise of exporters such as China.

Interestingly, over the 70 years, despite all the uncertainty and volatility caused by the issues listed above, UK equity market returns have been impressive – according to data from the annual Equity Gilt Study produced by Barclays, throughout the Queen’s reign, the average annual return on UK equities has been roughly 12% (being 6.4% in real terms plus the negative effects of inflation, which averaged just over 5% per annum over the period).

While over the 70 years UK equity market returns have been impressive, we obviously understand that no-one has a 70-year investing horizon – we believe that a 15+ year investment time horizon is more appropriate, especially given today’s retirement and life expectancy.

Back in 1952, when the Basic State Pension was only four years old, the retirement age was set at 65 for a man and 60 for a woman as life expectancy was just under 70 years of age. Today, it is over 80.

The FT 30 (also called the FT Ordinary Share Index) was the UK’s main index at the time Queen Elizabeth acceded the throne. The purpose of the FT 30 was to capture the spirit of the UK economy – much like the US Dow Jones Industrial Average.

Unfortunately, today the FT 30 is rarely updated let alone used. And unfortunately, Her Majesty’s reign predates the FTSE-100 (the UK’s best-known stock index today) which only started in January 1984.

Consequently, in the below data we have used the FTSE All Share Index, even though this was itself wasn’t started until April 1962.

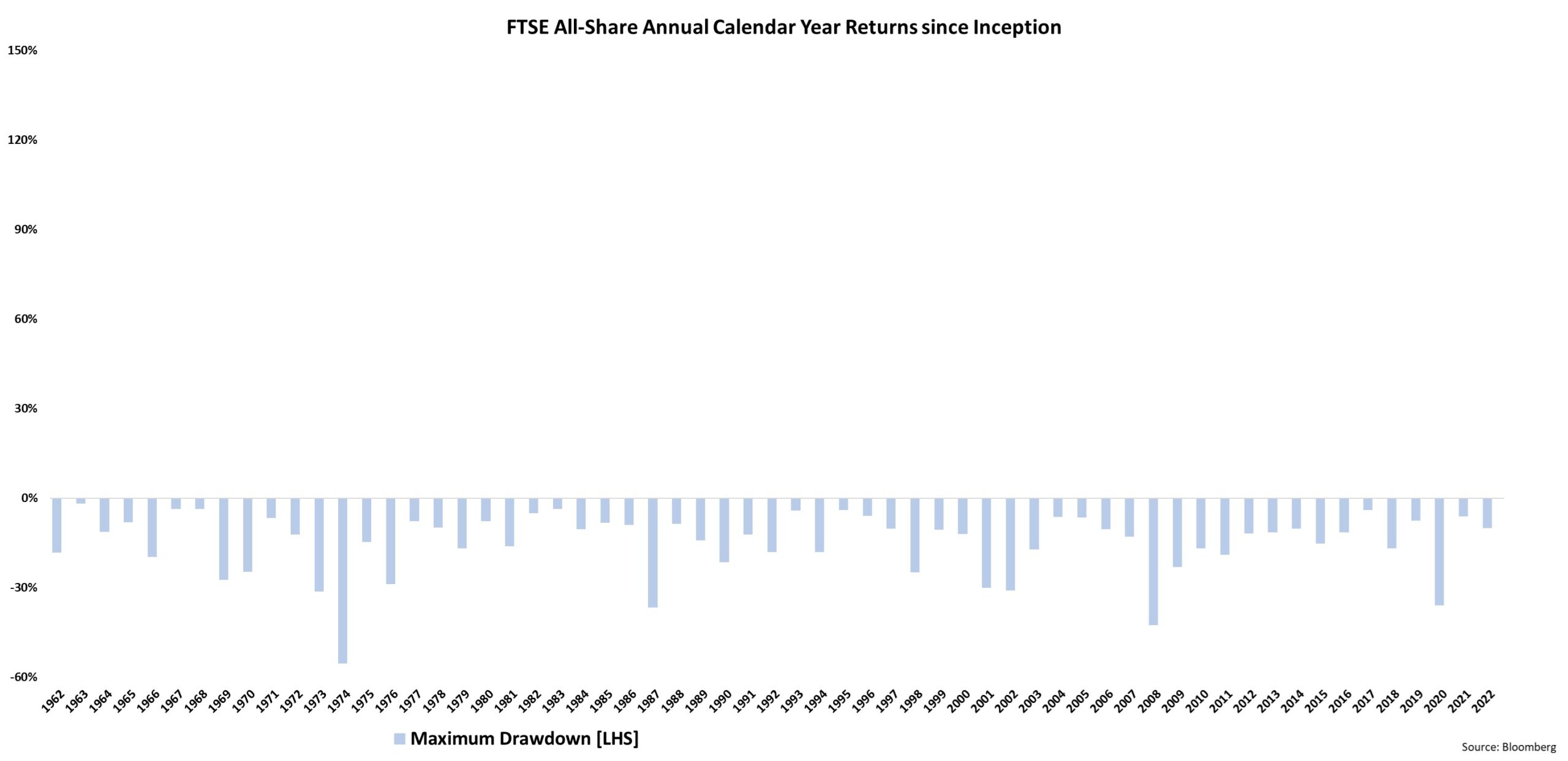

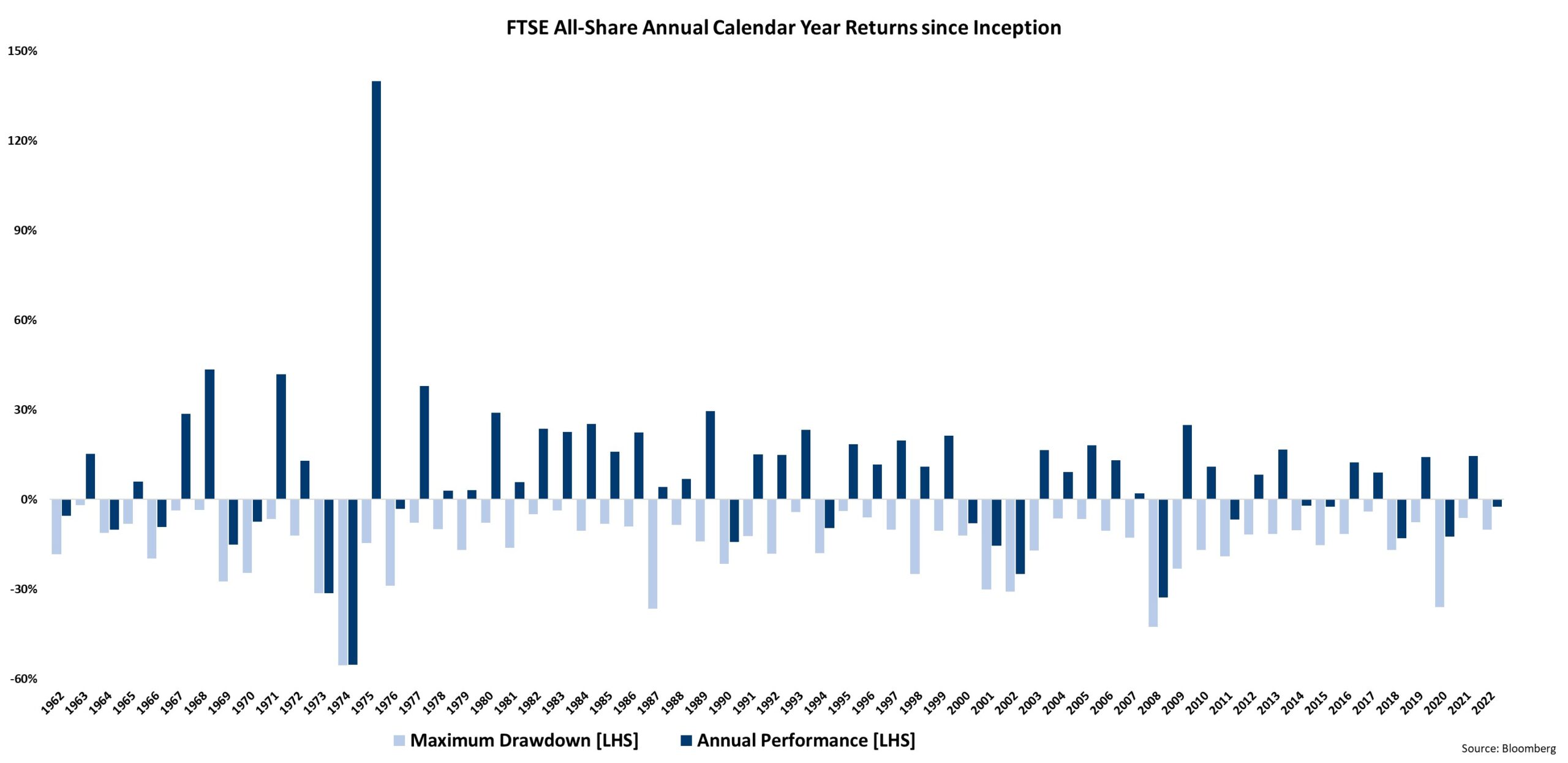

The light blue bars in the below chart shows that despite impressive long-term returns, equity markets will, at some point in a calendar year, see negative returns – often of 5% or 10%.

Despite these regular sell-offs, however uncomfortable they may be, as one can see when we overlay the chart with the annual equity markets returns (in dark blue), these intra-year sell-offs are quickly reversed allowing long-term investors to come out on top.

We believe that this illustrates an important, and timeless, lesson that one should never forget: while investing in equity markets is risky, it is obviously more so if one has only a short-term time horizon. The longer one is prepared to invest, the less risky it will become and therefore the greater one’s actual and real returns will become, as equities have historically weathered crashes, recessions and inflation.

For example, when the FTSE-100 had its biggest ever one day fall on 19 October 1987, not only did the FTSE-100 still end 1987 higher than it started, the losses were completely reversed by July 1989 and today, the crash is hardly noticeable on a long-term chart.

Whist we fully appreciate that the path for equity markets is never smooth or easy, and as such, it is easier said than done, but the best way to maximise returns isn’t by trying to time the market – it is to maximise time in the market.

In contrast, while one may consider cash to be a safe investment, there is a far greater chance of its value being eroded by inflation (which as we stated above has averaged just over 5% during the Queen’s reign) – and we don’t believe this is likely to change.

Looking ahead at what we can expect under King Charles III’s reign, as ever there is no shortage of risks that we could list – the most obvious include: hawkish central banks; inflation; the cost-of-living crisis; the UK’s trading relationship with the EU; supply chain disruptions; and the war in Ukraine.

However, history has shown us that global equity markets can deal with any eventuality, it simply hates periods of uncertainty – and what is happening today is far from unheard of. Unfortunately, it is not being helped by the fact that today we all know what is happening in real time given the number of 24 hour news stations and social media networks – which weren’t around in 1952.

As for what we are doing with our client portfolios given today’s uncertainties: we are going to follow the advice that the Queen no doubt gave King Charles before her passing: discipline, patience; consistency; and a preparedness to change. Which is actually the cornerstone of our investment philosophy.

For those with a my wealth portfolio, we have an active, discretionary managed approach to managing client portfolios, i.e. one where my team of qualified Investment Managers can react and adapt a client’s portfolio to the changing market conditions by making instant portfolio changes – which adds significant value over passive management.

However, my Investment Management Team aren’t given free rein to do what they like: managing clients’ life savings is a huge responsibility and one that needs discipline and rigid risk controls. In fact, risk management forms an integral part of our portfolio construction process and monitoring, as we believe that risk management is just as important as investment performance and returns

As a result, we will never shoot the lights out with our investment performance. Instead we aim to provide consistency: a small but consistent outperformance will generate superior long-term outperformance, as even a small uplift in annualised portfolio returns can lead to a significant difference in a portfolio’s value over time. While this disciplined investment process may not stop client portfolios from falling in the short-term, it should help to protect against bigger losses.

We are grateful to Her Majesty for a lifetime of devoted service in which she showed a strength and dignity to which we aspire.

God save the King.

The Investment Management Team