Spring budget commentary 2024.

8th March 2024

In what is likely to be the last fiscal event before the next general election, the Chancellor Jeremy Hunt has today delivered his Spring Budget.

As such, it was the final opportunity for the Chancellor to set tax policies that will steer the Conservatives towards the general election. With the Conservatives trailing Labour by around 20 percentage points, the Chancellor was under pressure to announce voter-pleasing tax cuts but as the phrase goes, ‘what the right hand giveth, the left hand taketh away’.

The right hand giveth…

As has been the pattern for many years, most announcements had already been leaked or rumoured in the days and weeks preceding the Budget. It was therefore no surprise when it was announced that National Insurance will be cut by a further 2%, down from 10% to 8%. This cut will mean someone on the average salary of £35,000 p/a will save up to £450 a year, adding up to £900 when combined with last year’s reduction.

This cut reduces the personal tax burden for employees, but this positive impact doesn’t extend to pensioners who don’t pay National Insurance.

The left hand taketh away…

Personal Tax Allowances and thresholds will continue to be frozen at 2021/22 levels until April 2028. One benefit of increasing the Personal Allowance would be that it could remove many pensioners from having to pay tax on their State Pension income.

However, continuing to freeze allowances and thresholds rather than raising them in line with inflation increases tax receipts, as rising wages and pensions tip ever greater numbers into the tax system or into higher rates -a ‘stealth tax’ through what is known as ‘fiscal drag’.

ISAs

In the Autumn statement, the government confirmed the freezing of the tax-free allowances for 2024/25 for the following:

- Individual Savings Account (ISAs) – £20,000

- Junior ISA – £9,000

- Lifetime ISA – £4,000 (excluding government bonus)

- Child Trust Fund – £9,000.

Jeremy Hunt has introduced the concept of a new ‘UK ISA’, which will allow an additional £5,000 ISA allowance for investment in ‘promising UK businesses’.

The new UK ISA allowance will sit alongside the £20,000 that can be invested across other ISA wrappers currently available, but it is unclear yet whether the extra £5,000 will be limited to small and mid-cap companies or all UK companies. A consultation will be published alongside the Budget later today and no doubt we’ll get further clarity in due course.

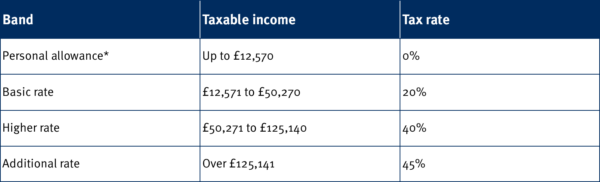

For the 2024/25 tax year, the tax rates and thresholds for England, Wales and Northern Ireland are:

Income, capital gains and savings taxes

*Your Personal Allowance may be greater than £12,570 if you claim Marriage Allowance or you are eligible for the Blind Person’s Allowance. It can also be reduced for high earners (earning more than £100,000) and is zero if your income is £125,140 or above.

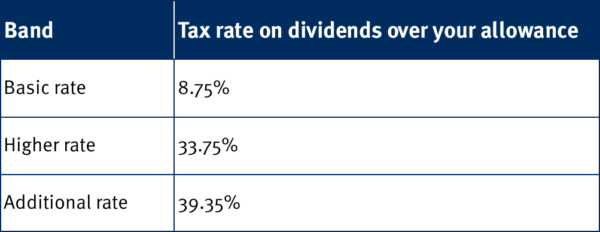

Dividend tax allowance

You only have to pay tax if your dividends exceed the dividend tax allowance of £500 in the tax year.

The tax you pay depends on your income band – please note, you must add your dividend income to any other taxable income to determine the rate of tax you will pay.

Capital Gains Tax (CGT)

The Annual Exempt Amount for capital gains tax is £3,000.

Above this, CGT will continue to be paid at 10% (18% for second properties or buy to let) if the chargeable gain fell within an individual’s basic rate band. Any gain that is above an individual’s basic rate band will be charged at 20% (24% for second properties or buy to let).

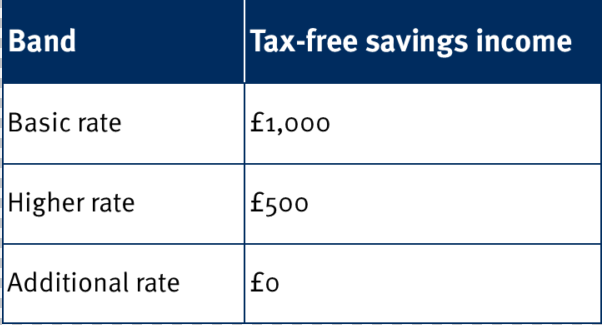

Personal savings allowance

This was first introduced in 2016 and applies to savings income such as interest on savings accounts, gilts or corporate bonds. The allowance remains at £1,000 for basic rate tax payers and £500 for higher rate tax payers.

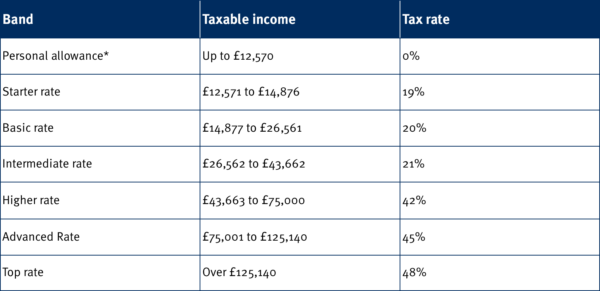

2024/25 Income tax rates for Scotland

*As with the rest of the UK, those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000.